Why do the costs of building nuclear appear to be rising over time, instead of coming down, as you would expect from other technologies?

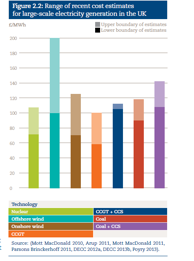

One of the biggest challenges we face in making the case for low carbon nuclear energy is “the economics don’t stack up”. Well-regarded analysis on behalf by the Committee for Climate Change, and helpfully aggregated in this graph below, by the UKERC, demonstrates that nuclear is among the most cost-competitive of all low carbon technologies (similar to the best estimates for on-shore wind). Yet the economics of nuclear remain very challenging.

UKERC: Presenting the Future: An assessment of future costs estimation methodologies in the electricity generation sector.

Inspired by Buzzfeed, here’s your guide to why the costs of building nuclear appear to be rising over time, instead of coming down, as we expect from other technologies. Enjoy!

- Commodity prices (meaning steel and concrete, for example) tend to be rising. Not much can be done about this, but it’s worth noting that volatile commodity prices drive up costs for all kinds of infrastructure.

- Design and regulatory approvals not completed before manufacturing and construction starts causes rework and delays. In the UK, the new Generic Design Assessment process is intended to iron out any regulatory wrinkles in the reactor design long before construction starts. The Office for Nuclear Regulation has now given the green light to the EPR reactor for Hinkley Point C, after four years of review, amendments and consultation. The proof will be in the pudding, but it is expected that this will result in far fewer delays or re-work during construction.

- So-called “nth of a kind” (NOAK) – as opposed to “first of a kind” (FOAK) – cost reductions are possible but can be offset by delays between projects. Also, changes in design, regulations, management, personnel, financing etc. that are allowed to happen or are required by regulator or investors can eliminate potential NOAK savings.

- NOAK reductions are achieved where management/government regimes are strong and do not allow changes or effectively incentivise NOAK reductions. China and South Korea are good examples.

- Nuclear energy is vulnerable to “cost shocks” when an accident happens, as with Three Mile Island and most recently Fukushima. For example, UKERC cite the rating agency Moody’s who estimated the Fukushima accident will likely result in a range of higher costs as a result of increased scrutiny, more stringent safety procedures and longer maintenance outages.

- Risk finance can be high and very variable from country to country dependent on finance package and where ultimate risk lies. The Coalition Government’s “no subsidy” commitment means the UK is particularly prone to risk finance because of our private-sector funding policy. Financing any major new infrastructure through the private sector is challenging, but to achieve this for nuclear will be heroic. With such a large project with a long construction lead-time, and 60+ years of operational life, the upfront cost of capital is enormous. Added to this, the political risk associated with nuclear projects (which need a public confidence licence to operate), it is no wonder that financing is expensive. It’s worth saying of course that herein lies the logic of Electricity Market Reform: left to its own devices, the market will build gas, since it’s cheap to build and the risk lies in the fuel price volatility, which can readily be passed on to the consumer. All low carbon electricity generation technology shares the same challenge of high upfront capital costs that presents a risk to the investor, whilst low operating costs offer a benefit to the consumer.

- Building up skills and supply chain to maximise UK content and drive down costs takes time. The Nuclear Industrial Strategy, which the Government published last year, outlines the potential economic, skills and industrial opportunities associated with a new build programme. Around 32,000 new jobs could be created during the current planned 16GW programme. By strengthening the UK industrial base in this sector the global market potential (anticipated to worth up £1trillion over the next 15 years) is hugely promising.

I would be interested to know if others have views on this list, either comments or additions. But before I go, one thing you may have noticed that is NOT on the list: Waste. You may have noticed that the costs of managing and disposing of waste are not included as a significant feature determining the economics of nuclear. This is because decommissioning costs for nuclear power plants, including disposal of associated wastes, are reducing and contribute only a small fraction of the total cost of electricity generation.

In most countries new build operators will be legally required to save an independently verified set amount of money throughout the operation of the plant, which will pay the costs of decommissioning, managing and disposing of the waste. In the UK, this cost will be included in the strike price agreed through the contract for difference, but over the lifetime of the plant, does not represent a significant financial burden. The independent board established to monitor, review and scrutinise this Funded Decommissioning Programme is called the Nuclear Liabilities Finance Assurance Board, chaired by Lady Balfour.

Meanwhile, the lion’s share of the huge budget (from DECC to the Nuclear Decommissioning Authority) associated with nuclear decommissioning in the UK is spent on cleaning up military facilities dating back to the Cold War. These costs are not representative of decommissioning costs for modern civil nuclear plants, which are designed to be cleaned-up after the end of their operating life.

So we know why costs are rising. If we are serious about tackling climate change, the next challenge is how to bring costs down. There are plenty of people puzzling over this. Here’s a great contribution that I would recommend, from the Breakthrough Institute, How to Make Nuclear Cheap.

First published on Business Green.

I think your reason 6 dominates.

[ see page 60 here, “Power from Nuclear”, by Carbon Connect: http://www.policyconnect.org.uk/cc/sites/site_cc/files/carbonconnect_powerfromnuclear.pdf ], and ‘The difficulties of developing and financing new nuclear’ – Alexander Johnston (slides): http://www-diva.eng.cam.ac.uk/mphil-in-nuclear-energy/external-lectures/2011-12-lectures/the-difficulties-of-developing-and-financing-new-nuclear-alexander-johnston

Compare the difficulties of commissioning gas vs. nuclear in Alexander’s slides.

As for money, the overnight cost of a new gas plant is much lower than that of a new nuclear plant. Over the cost of the project lifetime, gas capital costs are about 15% of nuclear. Nuclear will take longer to build and a ROI can’t be expected until many years after the plant starts. I think that’s why the government offered such huge bribes to the EDF consortium: of 20%+ profits during the latter years. To induce them to commit capital now. Capitalists hate spending money. In Britain, a project with a ROI after 5 years is considered a long-term investment. Imagine what they must think of one with a ROI after 10 years! They are very short-termist, and focused on spending the least amount of capital. Gas gives them the options they want:

* quick ROI,

* low risk,

* small capital outlay,

* easy to put up electricity price if wholesale gas costs rise.

I, personally, discount worries over safety with modern designs. New reactor designs are earthquake proof, have negative void coefficients, passive safety, defence in depth with multiple redundant safety features and containment vessels able to withstand jet-liners. Nuclear fuel costs are also stable.

I forgot to answer the question.

A. Give investors large, guaranteed profits like they’re doing at Hinkley C

OR

B.1. Shorten build time dramatically by using modular designs, factory built and assembled on site. [not necessarily only SMRs, the AP1000 is a modular design too]

B.2. Reduce overnight build cost dramatically by using non-pressurised reactors (breeders). They are smaller too.

B.3. Speedup innovation by standardizing on the approval process. The EU, USA, Canada and Japan should set up a single nuclear approval body, so that a new design need only go through an approval process once. This body will probably take the strictest standard from each country. It will help little countries install nuclear, too.

B.4. Move to breeder reactors to eliminate the fuel costs in mining, milling, extraction, enrichment, fuel fabrication. The IFR, S-PRISM does this. The LFTR will too.

Great points. Particularly interested in exploring B.3 further – a single nuclear approval body.

I would also add: the creation of an international fuel bank.

Clearly, there is plenty of room for innovation to enable nuclear to be scaled up internationally. A globalised solution for nuclear requires that it is (even) safer, waste can be recycled, proliferation risk eliminated, and the economics less challenging. Standardised designs that are approved by an international regulatory agreement, to enable cost effective mass production and deployment, with less localised safety/security infrastructure requirements: then we’ll really be cooking with gas.

Thanks so much for your great comments. Alexander’s slides are excellent.

Great post, thank you. As an advocate in a non-nuclear powered nation, cost remains a perplexing area and one subject to a lot of, shall we say, selective manipulation in discussions. That was a very helpful list. It reinforced two important points that I have drawn on previously 1) generalising costs from one market to another is not likely to be accurate. Much better to look at the comparative costs for technologies within each market 2) Learning happens in exactly the conditions one would expect; steady build programs with high certainty.

In my opinion Australia is relatively well-placed to exploit the global competition for nuclear build. Our research reactor, which ANSTO are very, very pleased with was a competitive process, with the surprise win being an Argentine consortium. We are not beholden to nationalised providers, our market is not already dominated by a player. I would imagine, much in the case of the UAE, were we to open our market to a turn-key solution we get get something very competitive indeed.

I think each of these 7 observations can serve as a valuable kicking-off point for finding ways to make nuclear power plant construction cheaper.

1. Steel and concrete prices may be rising, but they do not dominate construction material cost really. The problem is the imposed requirement for special materials and part-tracking that is adding nothing to the reliability of the plant. These controls are hold-overs from an earlier era of manufacturing and should be removed – nuclear plants could easily be built – for the most part – with high-grade but standard parts and materials.

2. Design and regulatory approvals are a serious issue in driving up cost that could be rolled back. Again the issue is that entrenched processes that do not reflect current methodology are adding useless layers, loops and lags to the approval process.

3. Learning by doing is what the “Nth of a kind” savings reflect. Putting nuclear on a even footing with other carbon-free generation sources would help to improve the rate of construction and help to bring these savings to fruition.

4. The China and South Korea experience is more about government commitment, I’d say. The UK has an opportunity to show the same commitment, with all major parties now on board with nuclear power.

5. I think the accident cost shocks are a symptom of a lack of political courage. The need to “do something” makes nuclear power an easy target for disruption. In Japan, were all communities anywhere on the shoreline evacuated “just in case”? No. But all nuclear plants were shut.

So the solution, perhaps, is a rationally based set of responses preplanned for various grades of accident. But a political promise NOT to jump into “punishment” mode.

6. I think it’s reasonable to offer a secure price for carbon-free electricity for a reasonably long timeframe. I even think it’s viable, right now, to offer a premium price for a long-enough period to recover construction cost.

7. This is point 3 repeated, to some extent, but I really fail to see how infrastructure investment jobs are anything but positive.

One important thing is to help people realize how laughably false most nuclear scare-mongering is. Nuclear power needs to be a normal and accessible feature of people’s lives. Tours of nuclear plants, great educational material, positive reactions to new plants from political figures – these kind of background improvements can help nuclear power realize its potential for powering a climate-safe and prosperous future.